While self-storage continues to rank among the highest-margin real estate asset classes, a more realistic benchmark for well-operated facilities today is NOI margins in the 65% to 70% range. Public REITs may report higher margins in certain cases, but this is often attributable to portfolios with older facilities that benefit from historically lower assessed property tax bases rather than fundamentally different operating models. Cubix Asset Management’s portfolio consistently operates within the 65%–70% NOI margin range, reflecting current tax environments, modern operating costs, and disciplined expense management. This performance demonstrates that strong margins are achievable without relying on legacy tax advantages and instead through operational precision, technology-enabled efficiencies, and proactive asset management.

National Stabilization vs. California’s Early Stress Test

Nationally, self-storage entered a stabilization phase in 2025 as new construction pipelines moderated and advertised rents returned to low single-digit year-over-year growth. Planned deliveries declined meaningfully from prior-year peaks, helping to rebalance supply and demand in many markets (Yardi Matrix, 2025; StorageCafe U.S. Construction Pipeline Report, 2025). California experienced the same forces, but in a more compressed and visible way due to higher land costs, zoning constraints, elevated operating expenses, and heightened consumer sensitivity to pricing.

Why Regulation Arrived in California First

California’s passage of SB 709, into effect on January 1, 2026, formalized growing concerns around promotional pricing and rent volatility within the self-storage industry. The law requires clear disclosure of promotional pricing and caps rent increases at the lower of 5% plus CPI or 10%, directly targeting practices that have contributed to tenant churn and consumer complaints (California Senate Bill 709, Chapter 353, Statutes of 2025; California Assembly Floor Analysis, 2025).

Additional legislative activity reinforces this trajectory. AB 498, also enacted in 2025, modernized lien-notice requirements under the California Self-Service Storage Facility Act, particularly around electronic delivery and documentation standards, raising compliance expectations for operators (California Assembly Bill 498, Chapter 369, Statutes of 2025).

Technology as the Differentiator

Industry research consistently shows that operators leveraging technology outperform peers on both revenue and efficiency metrics. AI-driven pricing, business intelligence dashboards, predictive analytics, and smart-unit infrastructure are transforming self-storage from a passive real estate model into a data-driven operating platform (IBISWorld Self-Storage Industry Report, 2025; JLL Self-Storage Outlook, Q1 2025).

As pricing transparency and operational discipline become non-negotiable, particularly in regulated markets like California, the role of technology has shifted from convenience to necessity. The operators pulling ahead are not those replacing people with software, but those using technology to sharpen execution at every touchpoint.

“Technology doesn’t replace good operators—it amplifies them. When data, automation, and people work together, you get stronger retention, more predictable revenue, and better long-term asset performance. That’s the model we’ve built at Cubix.”

Sean Venezia, Partner at Cubix Asset Management

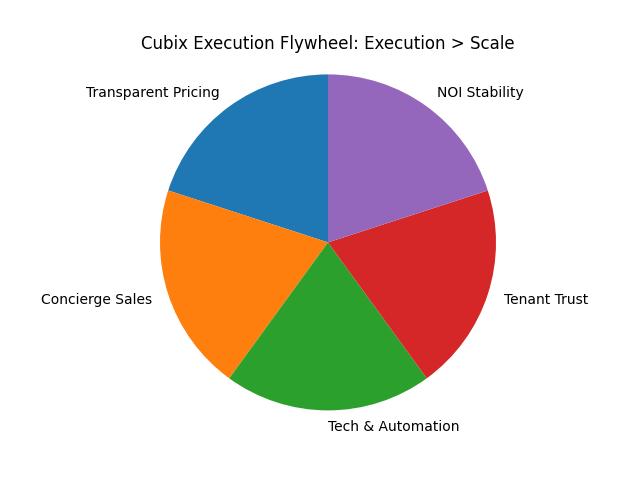

The Cubix Execution Flywheel: Execution > Scale

Cubix Asset Management operates on an execution flywheel designed to compound performance over time. Transparent pricing builds tenant trust, trust improves retention, retention stabilizes NOI, and stable NOI enables continued investment in technology and concierge-led sales. This integrated approach reflects best practices observed across high-performing self-storage portfolios (Cubix Asset Management Internal Performance Data, 2024–2025).

California as Proof of Concept

California serves as a proving ground for modern self-storage operations. Achieving national-level NOI and occupancy performance in California requires materially stronger execution due to higher labor costs, utility expenses, taxes, and regulatory complexity. Operators that succeed in this environment demonstrate a level of discipline and operational rigor that translates effectively across less constrained markets (Yardi Matrix, 2025; Cushman & Wakefield, 2025).

Conclusion

California is not an exception—it is a preview. As pricing transparency, compliance, and operational discipline become table stakes across the country, operators who master execution will lead the next cycle. Cubix Asset Management helps owners navigate this shift with a repeatable, technology-enabled framework designed to deliver durable NOI growth without relying on volatility.

To learn more, visit www.CubixAssetManagement.com

About the Author: Francesca Venezia leads Business Development and Strategic Partnerships at Cubix Asset Management, working with self-storage owners, brokers, and partners to support growth through disciplined operations, transparent pricing, and technology-enabled execution. She contributes to Cubix’s thought leadership by translating market trends and regulatory developments into practical insights for operators navigating an increasingly complex self-storage landscape.

References

• Yardi Matrix, National Self-Storage Report, 2025

• Cushman & Wakefield, Self-Storage Outlook, 2025

• StorageCafe, U.S. Self-Storage Construction Pipeline Report, 2025

• IBISWorld, Self-Storage Industry Report, 2025

• JLL, U.S. Self-Storage Outlook, Q1 2025

• California Senate Bill 709, Chapter 353, Statutes of 2025

• California Assembly Bill 498, Chapter 369, Statutes of 2025

• Cubix Asset Management Internal Performance Data, 2024–2025