The self-storage industry entered 2025 transitioning from a pandemic-driven surge into a cycle defined by stabilization, pricing transparency, technology-driven execution, and operational discipline. This white paper examines the 2025 self storage industry outlook, summarizing the data, legislative developments, operator sentiment, and performance insights that defined the year, while outlining why Cubix Asset Management is positioned to lead the sector in 2026.

1. The 2025 Market Reset: Cooling Supply & Stabilizing Demand

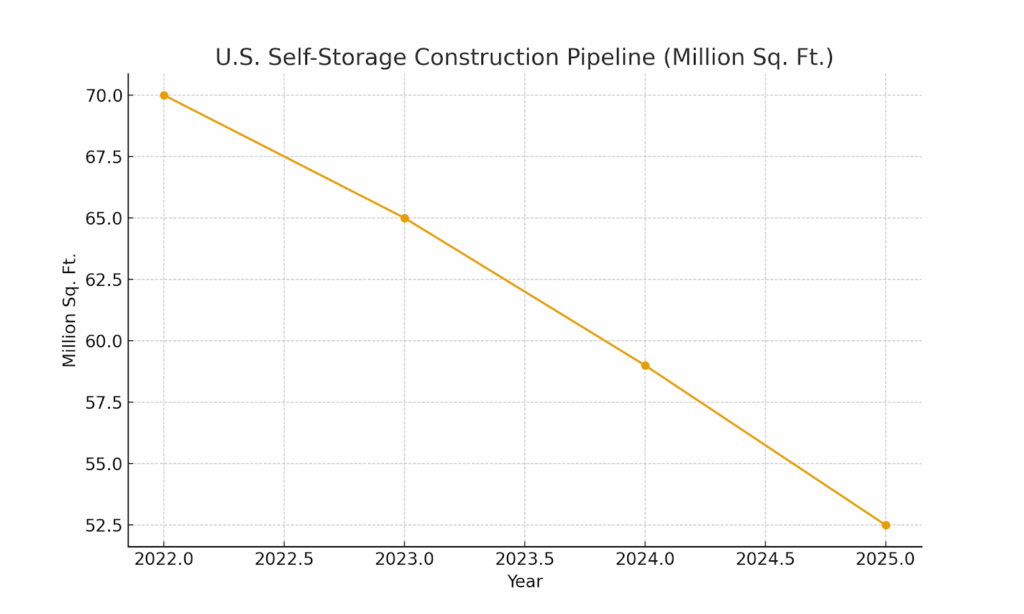

After years of oversupply risk, 2025 marked a meaningful moderation across key performance indicators. Planned U.S. completions fell to 52.5 million sq. ft.—an 11% year-over-year decline (Source: StorageCafe 2025).

Despite elevated move-in and move-out activity, occupancy remained essentially flat through the second half of the year, creating what Storable describes as a ‘busy but stagnant’ environment (Source: Storable Industry Report 2025).

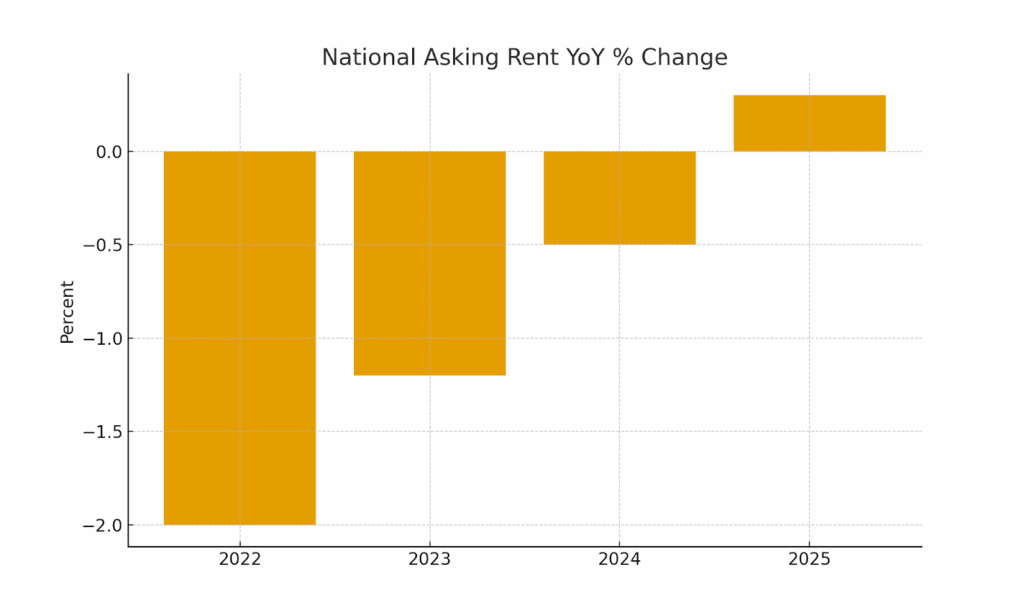

National asking rents rose 0.3% YoY in August 2025, the strongest lift in nearly three years (Source: Yardi Matrix Aug 2025).

REITs reported NOI declines of 2.4% for Q3, along with flat revenue performance and moderated occupancy (Source: Yardi Matrix Q3 2025).

H1 2025 investment volume reached $2.85B, closely mirroring pre-pandemic norms as investors shifted toward operationally driven value-add opportunities (Source: Cushman & Wakefield 2025).

2. Pricing Pressure & Revenue Compression—Unless You’re Running a High-Skill Model

Nationally, street rates declined approximately 4% in 2025, with move-in rates averaging $107.76 and showing no meaningful seasonal lift (Source: Storable Industry Report 2025).

However, Cubix outperformed the market despite these macro pressures, achieving:

• Revenue growth of 4.11%

• Rent-per-square-foot increase of 5.76% (from $1.74 to $1.84)

• Same-store occupancy decline limited to just 1.30%

These results excluded insurance, ancillary income, and smart-unit revenue—showing that growth was driven by core operational execution (Source: Cubix Asset Management Internal Performance Data 2024–2025).

3. REIT Rate-Bait Pricing: The Industry’s Most Damaging Trend

A key challenge in 2025 was the continued use of deep promotional discounts followed by steep post-move-in increases by public REIT operators. These practices fueled tenant churn, increased delinquencies, and attracted scrutiny from legislators and consumer groups.

4. California Legislation: Self-Storage in the Regulatory Crosshairs

California’s SB 709, effective January 1, 2026, introduces mandatory transparency requirements for promotional pricing and caps rent increases at the lower of 5% + CPI or 10%. The bill specifically targets pricing volatility common among REITs and is expected to influence regulatory discussions nationwide (Source: California SB 709 Full Text & Assembly Analysis 2025).

5. Operator Sentiment Entering 2026

Despite pricing pressure and rising operating costs, operators expressed strong optimism entering 2026:

• 65% optimistic

• Only 10% pessimistic

Concerns included economic uncertainty, competition, rising expenses, and stagnant street rates (Source: Storable Industry Report 2025).

6. Technology as the Great Separator in 2026

Operators cited their top differentiators as superior customer service (78%), competitive pricing (56%), convenience (26%), technology adoption (23%), and enhanced security (20%). The insight is clear: technology amplifies customer service at scale.

Cubix’s technology stack—including AI-driven communication, predictive analytics, business intelligence data, and smart-unit IoT automation—supports our dedicated concierge sales team, which consistently achieves conversion rates above industry averages.

7. Operational Challenges—and How Cubix Mitigates Them

Operators’ 2025 pain points included acquisition difficulty (23%), pricing pressure (21%), maintenance challenges (17%), rising delinquencies (14%), and technology implementation barriers (8%) (Source: Storable Operator Sentiment Survey 2025).

Cubix mitigates these pressures through disciplined SOPs, automation, standardized workflows, and revenue-optimization models that reduce labor load and increase consistency across facilities.

8. Cubix Case Study: The 2026 Operator Archetype

Cubix’s portfolio results reflect what a modern operator must execute to outperform in a stabilized market:

• 90.7% occupancy (Q3 2025)

• 4.11% revenue growth

• 5.76% rent-per-square-foot increase

• NOI outperformance relative to national REITs

“When technology and disciplined operations work together, performance follows. Our 2024–2025 results show that smart automation and data-driven pricing can drive NOI gains even when the broader market is flat.” — Sean Venezia, Partner, Cubix Asset Management

9. 2026 Market Scenarios: A Year Where Execution Matters More Than Expansion

Baseline Scenario: Stable occupancy, modest pricing gains of 0–2%, NOI growth driven by efficiency.

Optimistic Scenario: Increased housing turnover, move-ins up 3–5%, NOI expands as pricing firms.

Conservative Scenario: Economic pressure reduces demand, delinquencies rise, and pricing declines 1–3%.

Conclusion

2026 will not reward scale alone—it will reward sophistication. The operators who pull ahead will be the ones who master transparent pricing, real-time operational discipline, technology-enabled tenant experiences, and precision customer acquisition. In a market of tightening supply and rising expectations, these elements are no longer nice-to-haves; they are the new table stakes for sustained outperformance.

Cubix Asset Management spent 2025 refining exactly this model. While much of the industry navigated stabilization headwinds, our portfolio delivered consistent revenue growth, occupancy gains, and expense ratios 300–500 basis points better than the NCREIF average—all through a deliberate, differentiated approach:

- Fully transparent, data-driven pricing (no teasers, no surprises)

- 7-day live sales concierge coverage that turns weekend inquiries into same-day move-ins at full rates

- Smart-unit technology and automated workflows that lower costs and raise satisfaction

- Targeted digital acquisition systems that attract high-retention tenants

The result is a repeatable framework that generates superior risk-adjusted returns in any part of the cycle—without relying on promotional volatility or short-term volume spikes.

If you own self-storage assets and want to move from “hoping the market recovers” to systematically compounding value regardless of the macro environment, Cubix is built for that mission.

In 2026, the industry will separate the sophisticated from the status quo. Position your assets with the team already proving what’s possible.

To learn how Cubix can elevate your asset’s performance, visit: www.CubixAssetManagement.com